IBM Services

The Science Of IBM’s Holiday Retail Forecast—And Why Companies Count On It

|

The IBM Holiday Retail Forecast predicts a sales increase of more than 4 percent for the 2019 shopping season, compared with the 2018 season. Getty Images |

Given the trade war’s potential impact on consumer prices and signs that U.S. economic growth may be leveling off, it wouldn’t be crazy to think Americans will spend cautiously this holiday shopping season.

Not crazy—but wrong.

IBM’s Holiday Retail Forecast expects consumer spending between Black Friday and Christmas to be up 4.07 percent compared with last year, according to Michael Haydock, the IBM Fellow who crunches the numbers.

U.S. consumers are riding the positive tailwinds of low inflation and low unemployment. And their spending reflects rising disposable income—up 4.5 percent in the 3rd quarter of 2019, compared to the 2nd quarter.

And compared to last year, more shopping will happen in December, closer to the holiday, Haydock said. That seasonal enthusiasm will benefit brick-and-mortar stores, despite the long-term trend of retail moving online.

“People are going back to really Christmas shopping at Christmas,’’ Haydock said. “It’s more in the spirit of the tradition.”

Michael Haydock has been forecasting holiday retail sales for a quarter-century. IBM

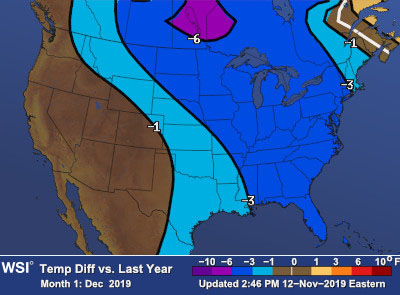

A December weather forecast of less snow and rain in most of North America compared with 2018 is expected to encourage people to get out of the house and into the shops, according to data from The Weather Company, an IBM Business.

Toy merchants can look forward to especially brisk business. Toy sales will be up more than 15 percent. Last year, after the liquidation of Toys R Us and the shuttering of all its stores, other big-box retailers had not fully expanded their toy departments to fill that void. This year, merchants are ready.

This year, however, with parents perhaps more inclined to amuse their kids than clothe them, the children’s apparel category could be down nearly 15 percent—one of the biggest category declines in Haydock’s forecast.

Casual dining establishments, where many of those holiday shoppers will be eating out, are another big beneficiary, with sales predicted to rise nearly 8.5 percent.

Not that people won’t still continue to shop from their smartphones and laptops. Online shopping, which had healthy growth—8.31 percent—during last year’s season, is poised for an even bigger surge this time, rising 11.36 percent, according to Haydock’s numbers.

And yet, despite the popularity of Amazon and other e-commerce merchants, online sales still account for only about 11 percent of the retail economy.

Chris Wong says a healthy economy and upbeat consumer is 2019’s shopping story. IBM

It all adds up to good news for retailers, many of whom have been worried about the effects of tariffs and mixed economic data this year, said Christopher Wong, VP of Strategy, Offerings and Alliances at IBM. Tariffs may begin having an impact on consumer prices in early 2020, as retailers restock. But a healthy economy and an upbeat consumer is this year’s holiday shopping story. “We’re projecting a continued robust shopping season,” Wong said.

Why the Numbers Matter

Along with closely watched forecasts from Adobe and the National Retail Federation (NRF), merchants use IBM’s forecast to help determine what inventory to stock and when to stock it during the month-long season that is famously the make-or-break period for the entire retail industry. (Black Friday gets its name from being the day when, traditionally, the retail industry hoped to break into the black for the entire year.)

IBM’s forecast this year is in line with the NRF’s projected growth for holiday shopping, in the range of 3.8 to 4.2 percent.

Many other holiday retail forecasts derive their projections in part from the same sources Haydock folds in – government data like the consumer price index, disposable personal income, household debt, and regional economic growth. But two factors set IBM’s forecasts apart: complex, proprietary AI algorithms that analyze the numbers, and highly detailed data from The Weather Company.

AI-powered analytics and granular weather forecasting make it possible to predict holiday sales with a precision that can let retailers know not only what specific products shoppers will demand, but also how much they’ll purchase and when and where they’ll buy it.

Haydock, who is also Chief Scientist, Global Business Services at IBM, began coding his holiday shopping algorithms years ago, after realizing that no existing software could provide projections with the kind of detail that retail clients needed.

He has been running these numbers, and fine-tuning his model for years. But only recently has neural network technology grown sophisticated enough, Haydock said, that IBM can determine what he calls the “character” of a geographic locale, revealing its residents’ likely spending habits.

For clients, IBM can predict consumer spending behavior down to specific products in individual stores—or “store-SKU” as it’s called, in reference to the Stock Keeping Unit barcodes that are fundamental to retail record-keeping.

It is IBM’s AI-based analytics—informed by rich data sources and site-specific weather forecasts—that make these micro, store-level predictions possible, and help retailers keep ahead of customer demand.

How Weather Influences Buying Decisions

“Store-level forecast is where the world is going,” said Paul Walsh, Global Director, Consumer Weather Strategy, at IBM.

Weather turns out to be the most important local variable in retail forecasting, surpassing broader economic data, Walsh said.

Paul Walsh says weather is the most important variable in local retail activity. IBM

And it’s not just current weather—is it raining or snowing right at this instant?—but weather forecasts that modify consumer behavior. Tens of millions of people check weather before making driving or commuting decisions, Walsh said. And these days, the near universal presence of mobile phones means consumers are even more likely to factor weather forecasts into their spending decisions.

“There’s only one reason we check the weather,’’ Walsh said. “It’s because we’re planning our lives.”

It’s easy to understand weather’s influence on spur-of-the-moment consumer behavior, like buying hot coffee in cold weather or purchasing an umbrella when caught away from home during a rainstorm.

But longer-term weather patterns have more fundamental effects on consumer behavior. The early cold weather that much of the country experienced in November, for example, meant that seasonal items—winter coats, gloves, snow blowers—were purchased earlier than they otherwise would be. That let retailers, in some parts of the country, stock fewer of these items for coming weeks. But particularly in the Eastern U.S., Walsh said, another stretch of expected colder weather in December could mean a surge of spending on winter apparel in the final weeks leading up to Christmas.

A colder December this year in North America could spur sales of winter apparel. IBM's The Weather Company

Some major U.S. retailers have learned to use IBM weather forecasting to ensure they had sufficient inventory of strawberry Pop Tarts and prepared chicken, said Walsh. The reason: both of these items disappear from stores when hurricanes are predicted.

What People Will, and Won’t, Buy This Year

Besides the overall downturn in clothing being forecast this season—a decline of 1.24 percent for the category as a whole—a dip is expected in consumer electronics. A relative dearth of new must-have gadgets will mean a decline of 2.24 percent in that category, IBM predicts.

But in contrast, appliance sales should be solid. The Haydock numbers predict a 3.87 percent year-over-year increase in holiday sales for the category—which includes everything from mixers to washing machines—driven in part by a recent upturn in U.S. home sales.

“You put all these things together and they indicate a healthy holiday season for retailers,” said Jane Cheung, Consumer Industry Research Lead at IBM.

Jane Cheung notes the effect of a late Thanksgiving this year. IBM

This year’s relatively late Thanksgiving, cutting six days out of the season, also plays a role, because it forced retailers to begin holiday promotions earlier this year, Cheung said. (If you heard Christmas music in stores alarmingly early this year, this could be why.)

All as it should be, according to the numbers generated by the dean of retail data, Michael Haydock.

“I am very optimistic,’’ he said, “that this is going to be an excellent year.’’

Matt Hunter, a longtime business journalist, is a writer covering IBM Services.