Latest News

How retailers can meet consumers’ growing demand for sustainability and hybrid shopping experiences

Consumer shopping preferences have changed greatly since the start of the COVID-19 pandemic two years ago. A new global study from the IBM Institute for Business Value (IBV) and National Retail...

Consumer shopping preferences have changed greatly since the start of the COVID-19 pandemic two years ago. A new global study from the IBM Institute for Business Value (IBV) and National Retail Federation (NRF) helps quantify what I discuss with clients every day – consumer expectations have increased, and so retailers and brands must work to meet the need for more personalized customer experiences, transparent supply chains, and agile operations.

Consumers surveyed seek to control the shopping experience, and “hybrid shopping” is here to stay

According to the study, many habits consumers adopted out of necessity during the COVID-19 pandemic are now the norm. Hybrid shopping – when consumers split their shopping journeys across multiple digital, physical, and mobile touchpoints – is the method of choice for 27% of consumers surveyed, and over 1 in 3 Gen Zers surveyed. And stores are still critical – nearly three fourths (72%) of consumers surveyed still use stores as part of their primary method of buying. The study shows consumers surveyed are also using more technology and fulfillment options in the shopping process – self-checkout, curbside pickup, scan & buy, local delivery, and contactless payments have all become commonplace – shifting how customer engagement, merchandise planning, supply chain, stores, and fulfillment needs to operate.

The rise of the purpose-driven consumer

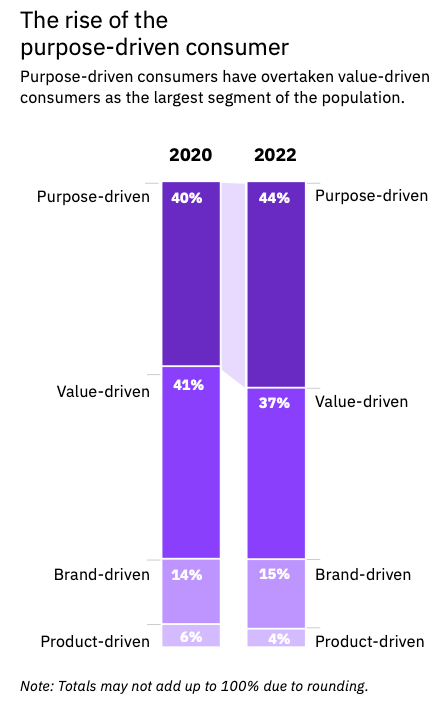

Two years ago, our Consumer 2020 study identified an emerging trend – consumers surveyed choosing brands based on how well those brands align with their values, rather than making purchases based solely on cost, selection, and convenience. We called this group “purpose-driven” consumers.

Today, purpose-driven consumers represent the largest segment (44%) of global consumers surveyed – and it's consistent across all major product categories. And these surveyed consumers are active and involved in the shopping process, engaged with retailers and brands, and eager for more information to help them make better decisions, according to the research. In short, they are ideal brand ambassadors, and thus a critical cohort for retailers to cultivate.

Consumers surveyed say sustainability is more important for purchase and brand decisions, but their actions don’t line up yet

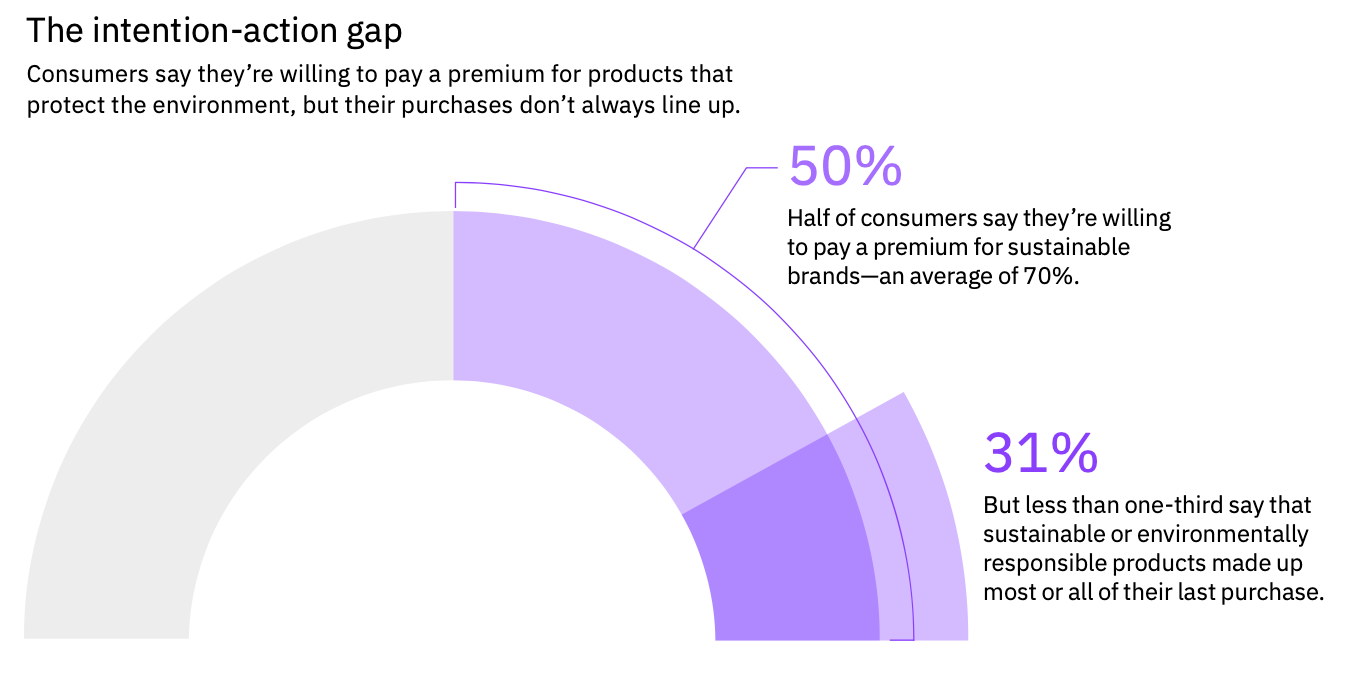

The research shows that 62% of consumers surveyed say they are willing to change their purchasing habits to help reduce environmental impact (up from 57% two years ago). More strikingly, half of respondents say they’re willing to pay a premium for sustainability – an average premium of 70%. This is roughly double the premium from 2020.

But these consumer claims remain somewhat aspirational. There’s a significant gap between what consumers surveyed say and how they actually spend their money. Only 31% of respondents indicated that sustainable products made up more than half of their last purchase.

One way to help close this gap is with transparency. About 1 in 5 respondents said that more information – what makes a product sustainable, where products are sourced, produced, and manufactured, and how to re-use, return, or recycle them – will help them buy more sustainably. As brands continue to invest in sustainability initiatives, their progress is being tracked in social media and broadcast by mass media, helping them attract purpose-driven consumers – or lose them.

Actions for retailers

It’s clear from the survey findings that retailers should streamline the hybrid shopping experience and make sustainable shopping much easier for their customers. Technologies such as AI, blockchain, and IoT can all be pieces of the puzzle. And developing these capabilities at the new speed of business requires advanced automation and hybrid cloud designed to help transform processes, improve operational agility and adapt to consumers’ changing needs.

Retailers can improve hybrid shopping by integrating their digital and physical operating platforms to help deliver an experience that leverages the strengths of each. Retailers should also understand which touchpoints are most important to which customers, and be prepared to make near real-time changes as their needs shift. This requires robust customer data platforms designed to collect and analyze information from internal and external sources to help them run the business at a more localized and individualized level.

It’s important to remember that despite all the activity around “digital” in the past 5 years, the industry is still in the early stages of full digital transformation. AI and hybrid cloud, along with intelligent workflows and other “nextgen” capabilities, should move beyond the pilot stages and become deeply embedded into retailers’ operations to help obtain the agility needed to run a successful business. These capabilities can be essential to improving self-service options, enabling store associates to play more strategic roles, deploying hyper-localized assortments at scale, operating a multi-speed supply chain, and delivering on ESG commitments.

As more consumers align their purchases with their values, retailers and brands can help close the intention-action gap by making it easier for their customers to understand how a given product supports sustainability. It’s important for companies to translate jargon into language that consumers can understand and offer tradeoffs between cost, service, and environmental impact that can empower consumers to make their own choices.

In this new shopping environment, agility is the name of the game, and leading brands and retailers recognize that technology is the ace up their sleeve.