IBM Services

What's in Store for the 2020 US Holiday Shopping Season?

November 17, 2020

By Karl Haller, Partner, Consumer Center of Competency Leader at IBM

The 2020 holiday season is a real challenge–no one really knows what holiday shopping will be like as there’s no real comparable situation and the macro-economic conditions are very fluid. That being said, from the early data IBM is seeing in consumer spending and retail sales, as well as looking at what consumers have told us with regard to their mindset, we are seeing some trends emerging.

Consumers will retrench somewhat

IBM’s latest holiday forecast is projecting a 1.8% increase in Nov.-Dec. retail sales vs. 2019. We expect sales trends to continue to be heavily weighted towards Essential retailers (home improvement, grocery, and mass discounters, and Ecommerce), which were able to remain open and operating during the COVID lockdowns and which, for many consumers, have become the habitual first-choice shopping destinations.

What's in store for the 2020 holiday shopping season? Here's a look at early trends IBM is seeing in consumer spending, retail sales and more: https://t.co/eOldU3TD6M pic.twitter.com/rU0paobYEc

— IBM News (@IBMNews) November 17, 2020

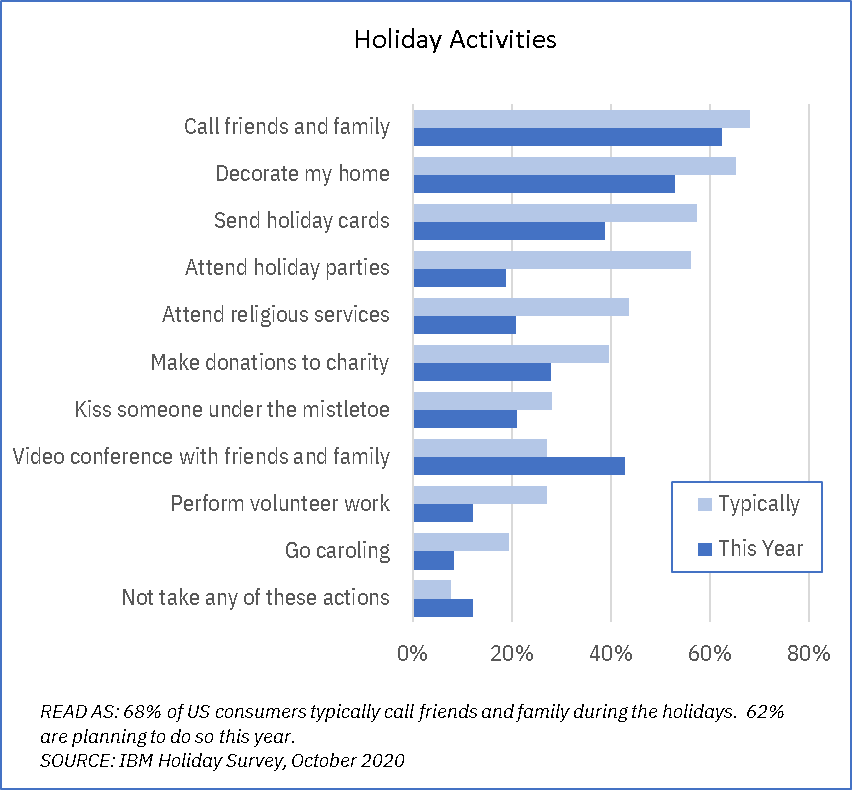

This trend is also reflected in results from IBM’s Institute for Business Value 2020 Holiday Shopping and Travel Trends survey, which indicated that consumers are scaling back on both holiday activities and on holiday spending. Participation rates in many holiday activities–sending holiday cards, attending holiday parties, even home decorating–have declined substantially. Not surprisingly, video calling with friends and family was the only activity which showed an increase.

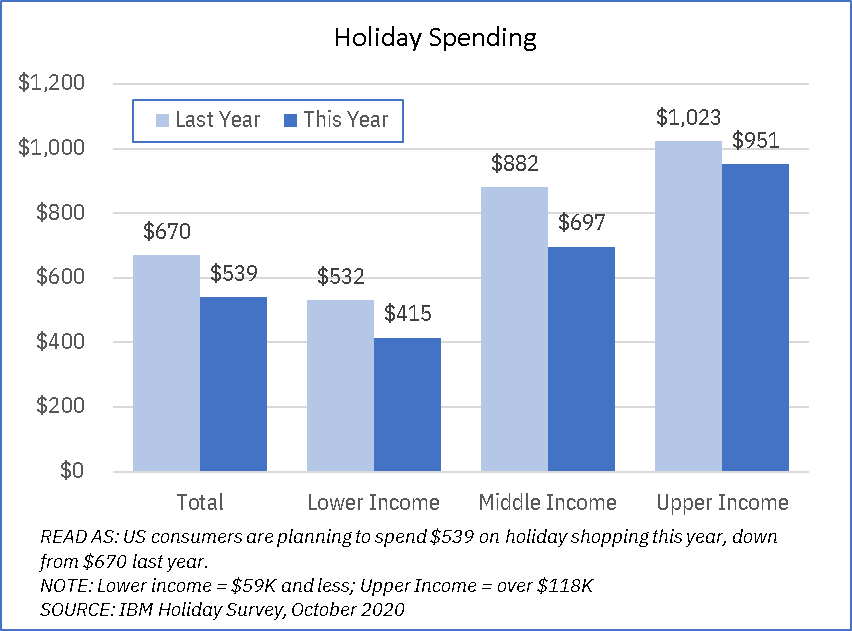

Similarly, consumers are shrinking their gift lists, with 29% buying for fewer people than last year (vs. 14% who are buying for more). Not surprisingly, consumers’ holiday spending is also declining by 19% vs. last year, from $670 to $539. Declines are greater among lower and middle-income consumers (each were in excess of 20%), while upper-income consumers are only reducing their spending by 7% (to $951).

Digital customer engagement will continue to reign supreme

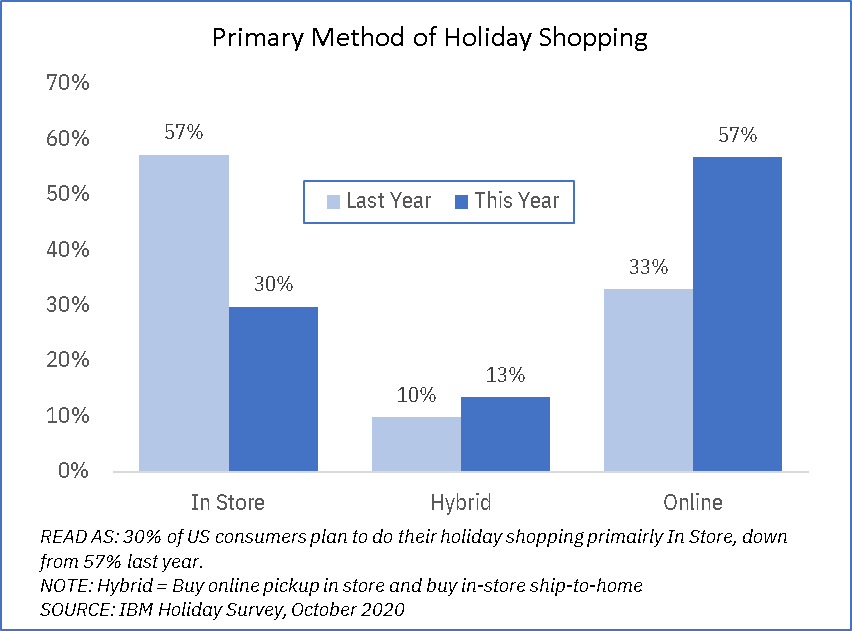

2020 will be a digital-first holiday. IBM is projecting sales at Non-Store Retailers will continue to surge, growing by 30% (vs. 2019) in Nov.-Dec., accelerating from growth of 24% during Mar.-Sep.

And spending is projected to continue to be skewed toward big-ticket purchases for the home, as consumers continue to be reluctant to spend on–or participate in–experiences. Spending on services and experiences are projected to fall by 26% this holiday and over half of consumers do not plan to visit public entertainment venues until at least 2021.

These shifts, combined with the recent increase in COVID cases, may catch both consumers and brands off guard, and we expect there may be continued sporadic shortages in big ticket items which have longer production cycles (e.g. cars, recreational equipment, home furnishings) as well as cleaning supplies and paper goods. In other areas, there may be shortages in niche items as manufacturers shift production toward higher volume SKUs–so certain niche products may not always be available.

Shopping patterns will continue to evolve

As shopping patterns continue to change, retailers need to be able to adapt quickly to the shifts. Four-in-ten (41%) mall shoppers indicate they do not plan to visit a mall until 2021, if ever, and those who are shopping in person are often doing so in a manner that blends digital and physical. We expect further increases in how consumers choose to receive their goods, building on the growth we’ve already seen in BOPIS and curbside pick-up, as well as the use of in-store lockers and other pickup locations. We also expect continued pressure on shipping, as more packages flow through the system this holiday season. As a result, we have already seen price increases by some of the major shipment carriers and earlier dates for guaranteed holiday delivery.

Lastly, as it often does, the weather will play a factor in how the holiday pans out for retailers. The latest forecasts from The Weather Company (an IBM business) indicate generally warmer temperatures than last year through mid-November, then switching to colder temperatures (vs. last year) for the balance of the holiday season. The shifts in temperature not only impact when consumers purchase items, but also what they shop for and how they shop. A switch to even cooler temperatures is yet another factor for retailers to consider as they try to capture a share of shoppers’ spend.

Karl Haller

Partner, Consumer Center of Competency Leader at IBM